Course Adjustments for the Major Content Developers/Deliverers

For the past three weeks, we’ve had a consistent set of dreams (sometimes nightmares) trying to figure out how the sc***ed up personal/home content production/distribution industry is going to get back on the path of being fun again … and making money.

We have two key problems:

- Wall Street “analysts” make outlandish projections to raise shareholder expectations and then “punish” services when they don’t meet the analysts’ wild projections

- The industry has so much potential that too many players have been attracted to the arena, knowing they’re going to be winners, regardless of how they muck things up

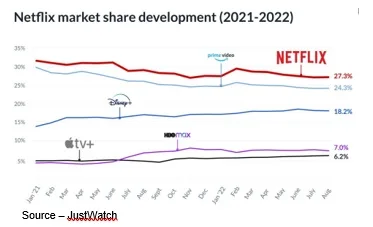

Even though the financial analysts don’t want to admit it, the market is finite:

- To qualify as a streaming content viewer, you need a screen – TV, computer, tablet, smartphone, whatever

- According to the UN, there are about 8B people on the planet today but 2.7B folks aren’t connected to the internet. That’s 1.8B TV households (2.6 people per household), 78 percent of total households

- Digital TV Research projects there will be 1B pay TV subscribers in 138 countries – mostly developing countries – by 2027

- More than 700 services – most local/regional – are vying for the 1.8B on-demand prospective viewers (subscription, FAST, ad-supported)

But before you think our dreams covered all the answers, we’ll admit we only focused on the issues and solutions of the key players.

It’s little wonder that services in the Americas (47 percent of total market) are salivating to be leaders in the $80B plus global market this year.

It’s little wonder that services in the Americas (47 percent of total market) are salivating to be leaders in the $80B plus global market this year.

Each is bullish about their growth potential.

They believe they have just the content people have been waiting for and it’s so good, they’ll be willing to pay a little more to get this great content.

But they aren’t.

They’re focusing on specific content, not in accumulating services, as churn numbers – 37 percent average – prove!

In addition, people have other little things to worry about like food, housing, insurance, something left for tomorrow and a real life away from the screen.

An increasing number of folks have “discovered” you can coordinate your entertainment with friends and neighbors by sharing passwords.

Or, in a pinch, you can cancel the service and just pick up the shows/movies you want at your friendly pirate service.

What could it hurt?

Beyond hardening user password management and increasing content security; they must give people options including ad-free or ad supported choices as well as broader entertainment choices to strengthen their position with customers.

It’s relatively simple for the tech-based streaming services like Netflix, Amazon Prime and Apple TV+.They don’t have to make massive adjustments of businesses that have been shaped by Hollywood relationships and written/unwritten show biz “rules.”

Those are the changes we worked on during our sleeping hours and it was far from simple.

But even tech streamers need to be tweaked.

Netflix, the folks who started the eyeballs grab, is already well positioned in 190+ countries with extensive content creator relationships to serve local viewers as well as greenlight projects which have broader regional and often global audience potential.

With a momentary dip in subscriptions to 221M plus earlier this year, they’re making adjustments to stay on track to be the industry revenue leader to chase.

To illustrate their strength and global focus, they recently used their global event TUDUM to unveil their original movie/series slate for the remainder of the year with over 200 global stars highlighting over 120 series, seven- and 14-day theatrical exclusive and concurrent window films and games.

The event racked up nearly 50M views to rejuvenate their growth and marked a shift to increasing global subscribers rather than relying on an over saturated Americas market.

It’s a poorly kept secret that the company is shifting from ad-free subscription only ($20 tops depending on where you live) and adding FAST and ad-supported options to capture more subscribers’ attention.

Netflix’s Reed Hastings didn’t like the idea of ads interrupting content but he has since learned that targeted and limited numbers of ads can be interesting–much better than the barrage of ads he was accustomed to seeing in legacy TV.

The growing range of more economically produced national/international viewing fare, gaming and flexible subscription options should stimulate more subscribers and enhance its ARPU (average revenue per user).

With an estimated global subscriber base of 200M+, Amazon Prime was the first to become a family entertainment service with its broad selection of on-demand content in their MGM, Amazon studio and global partner library of original series and films.

In addition, they have FreeVee ad-supported content and entertainment options including books, gaming, children projects and a growing family of sporting events including Thursday night football.

Oh yeah, the full Amazon Prime membership also includes free delivery of darn near anything you want for home, office and personal use.

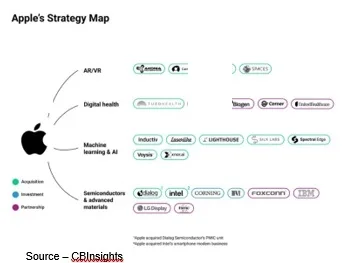

While Apple is best known for making huge sums of money with its hardware masterpieces – computers, tablets, iPhones – and loyal (fanatic) global following, the company has made strong investments in major technology for consumers in all phases of their lives.

Apple, which has grown its service segment – Apple Music, Apple TV+, gaming, publications, personal healthcare and other entities – racked up nearly $20B and 825M paid subscribers last quarter.

In the last two years, Apple TV+ has embraced streaming video that best supports its image with shows/movies that are consistent with their brand to attract an estimated 40+M subscribers in more than 107 countries.

Like Amazon, Apple has been a strong supporter of theatrical distribution as a part of its marketing strategy, which has earned it Oscars and Emmys for projects like CODA, Ted Lasso, Carpool Karaoke, Severance and more. It has earned the company more than 250 wins and more than 1,100 nominations.

While the company’s video content spending may pale in comparison to rival streamers, it resonates best where it counts most … with the consumer.

In the next two years, the company will be dramatically extending its footprint in the content creation industry. There are just too many good but struggling/fumbling organizations and teams out there that want to focus on great projects backed up by a quality-focused boss.

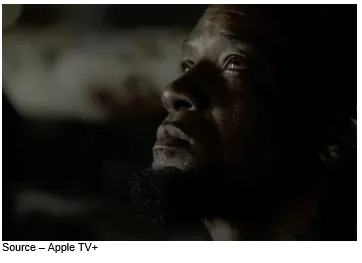

Toward that end, we really looked forward to seeing Will Smith’s Emancipation.

Even if the film is determined to be ineligible to take home an Oscar by the Academy because of Smith’s last year slap, we’re betting the film earns strong viewer accolades.

It’s still the Academy’s call but the Hollywood establishment has long tolerated and/or turned a blind eye to worse things. In the final analysis, audience response is what really counts most for the industry, Apple and Smith.

It’s still the Academy’s call but the Hollywood establishment has long tolerated and/or turned a blind eye to worse things. In the final analysis, audience response is what really counts most for the industry, Apple and Smith.

Once you move past the tech streaming players, the competition from studios and veteran content delivery services gets messy.

Everyone understands linear TV – news, a little sport, reality shows and second-tier dramas – is dwindling and options – sales opportunities for studios/independents – are fading.

Streaming is rapidly replacing pay TV and the stage is crumbling under traditional players as they struggle to fit into the growing “new” market and manage the decline of life in a dwindling market.

Tech and veteran entertainment providers are trying to determine how get their share of the $86B SVOD market, which is projected to grow to $118B by 2027,while developing hybrid to appeal to budget conscious new and “downgrading” customers.

While original and library content is important, so are ad loads, ad placement (pre-roll, instream) and enhanced ad formats. Omdia projects that online advertising will grow from $119B this year to $326B by 2027 to support increased project production and satisfy shareholders.

The best stance for the new bosses (experienced, long-tenured executives are few and far between) will be knowing what they don’t know.

Disney has the scale and global image to share the top streamer crown with Netflix and achieve CEO Bob Chapek’s goal of 230-260M subscribers by 2024.

The family-friendly content company already has a strong presence in 100+ countries and has the experience (and seasoned team) with its integrated organization that includes Disney Pictures/Animation, Pixar, Marvel, Lucasfilm, 20th Century studios/animation, India-based Hotstar and Europe’s Star platform relationships.

Disney+ is adding an ad-sponsored tier and the introduction of broader appeal general content beyond its standard family-fare.

Chapek expects Disney+ to reach SVoD revenues of $15B by 2027 with SVOD subscription/ ARPU growth in key markets as the company rolls out it’s hybrid AVOD/SVOD tier.

While both Disney and Comcast want to own 100 percent of Hulu by this time next year (Comcast owns 33 percent), we see Chapek adding the subscription streaming VOD pioneer to the Disney ecosystem following a spirited bidding war that should yield Comcast much more than the agreed upon base of $28B.

The Americas-based Hulu has been under the management control of Disney since the beginning, has 46.2M subscribers interested in more mature content which will be of interest to folks to enjoy after the kids go to bed.

Besides, in our industry realignment dreams, we see a better investment opportunity for Comcast’s boss, Brian Roberts, to breathe new life into the company’s struggling NBCUniversal/Peacock (15M subscribers) group.

Warner Bros/HBO has had a tough time the past few years.

Warner Bros/HBO has had a tough time the past few years.

AT&T’s Randall Stephenson buying the key content developer/distributor and then turning the task of “remaking” it to John Stankey when he took over the phone company’s CEO role.

He very quickly brought on Jason Kilar to thin the ranks and rearrange the chairs which included pushing theatrical releases concurrently to HBO Max, which pleased no one and produced a boat load of red ink.

Stankey decided to get out of the creative content industry, negotiating the marriage of the tarnished organization to today’s Warner Bros. Discovery headed by David Zaslav along with a debt load of $50B-plus.

Living up to his image as a tough boss, Zaslav implemented many of the tactics of someone he strongly admires – Jack Welch – restructuring everything which has often included replacing established, highly-regarded industry executives with more trusted/familiar Discovery team players and pulling projects from the release schedule, citing opportunities for significant tax write-offs to reduce their debt overhead.

To polish the financial and growth potential of the new WDC, CFO Gunnar Wiedenfels has noted that the theatrical window is a relative strategy and that the company is leveraging all its exploitation windows to use the firm’s position to monetize all of their content as much as possible.

He equated the present media giant to a Boeing 747 flying on one engine.

Some think Zaslav might want to consider bringing Colonel Kim Campbell on board to fly the “747” as she did with her A-10 Warthog, bringing back and landing her heavily damaged craft during combat over Baghdad in 2003.

It’s hell flying, modifying and landing a plane when you’re at 30,000 feet without an overly experienced crew.

Zaslav is finding it very difficult to find a skipper and crew to take control of DCEU (DC Extended Universe) superhero film/series organization–especially when he’s been pitching a 10-year plan for DCEU modeled after Disney’s highly successful (and profitable) Marvel Entertainment.

While Zaslav has said WBD will invest “smartly” in new film/series projects for theatrical and HBO Max release that spans all genres, the company has shuttered the production of films for HBO Max, including the removal of 68 titles and more than 200 episodes of Sesame Street to avoid royalty payments.

Layoffs and cost cutting across the organization have produced more than $3B in savings with more in the offing and Zaslav has been quoted as saying he thinks “scripted has had its moment.”

The comment tends to favor reality TV which is cheaper and has historically been Discovery’s strong suit. A lot of the merger details of HBO Max and Discovery + are also works in progress.

Amidst the chaos, confusion and upheaval, Zaslav emphasizes that the new organization is committed for the long-haul as a “pure play content company.”

Sometimes resolutely renouncing the idea of considering the sale of parts might be part of the long-range strategic plan.

It would certainly open the door for Comcast’s Roberts to combine NBCUniversal and WBD into a serious theatrical, appointment viewing and streaming organization that has a solid understanding of the content industry, as well as reputable relationships and a professional view as to what it takes to develop/deliver entertainment to folks.

The combination would certainly provide the scale needed to be a solid front door for a complete range of content that creators want to create and consumers want to view in the theater and on their household/personal screens.

Sure, there are other content producers/distributors we thought about in our industry planning dreams that need to and will survive/thrive.

That’s because we agree with what Sonny said in The Best Exotic Marigold Hotel, “Everything will be all right in the end… if it’s not all right then it’s not yet the end.”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.